Swiss shops are dying – is retail on the verge of collapse?

Switzerland’s retail landscape is dying out. Over 3,000 small shops have disappeared in the last five years. Restaurateurs and hairdressers are competing for prime locations – but not everywhere. Where is the Swiss retail landscape headed?

The facts

Thousands of retail stores have disappeared in recent years. A recent study by Credit Suisse shows that the number of retail outlets in Switzerland has been steadily declining since 2013. In 2013, there were just under 53,000 retail outlets. By the end of 2018, there were around 50,000.

Turbulence thanks to the euro, shopping tourism and online trading

Why are so many stores closing? The euro’s decline over the course of the year has made shopping abroad more attractive. In addition, price levels in Switzerland have risen comparatively more sharply than in neighboring countries. The effects of the exchange rate and the price difference are as follows: In 2019, Swiss consumers paid 48% more than Germans and 41% and 42% more than French and Italians, respectively, for the same shopping basket.

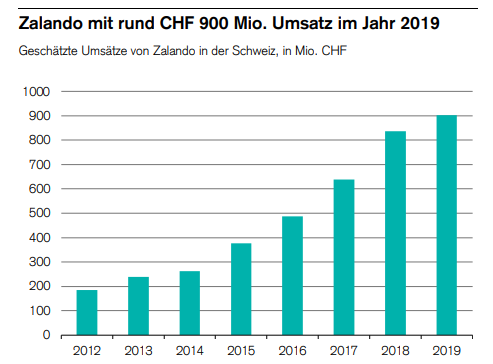

The development of the individual retail segments showed a similar picture to the previous year. Brick-and-mortar clothing retailers, in particular, continued to lose market share to online retailers, particularly Zalando. This led to a sales decline of -4.5%.

The structural change has greater consequences than expected

Not only is the number of retail outlets declining, but so is the supply of retail space. When a store closes, it is often difficult for landlords to find a replacement. At the end of 2018, almost 330,000 square meters of retail space were vacant and advertised for lease online – equivalent to three times the area of Zurich’s Sihlcity shopping center.

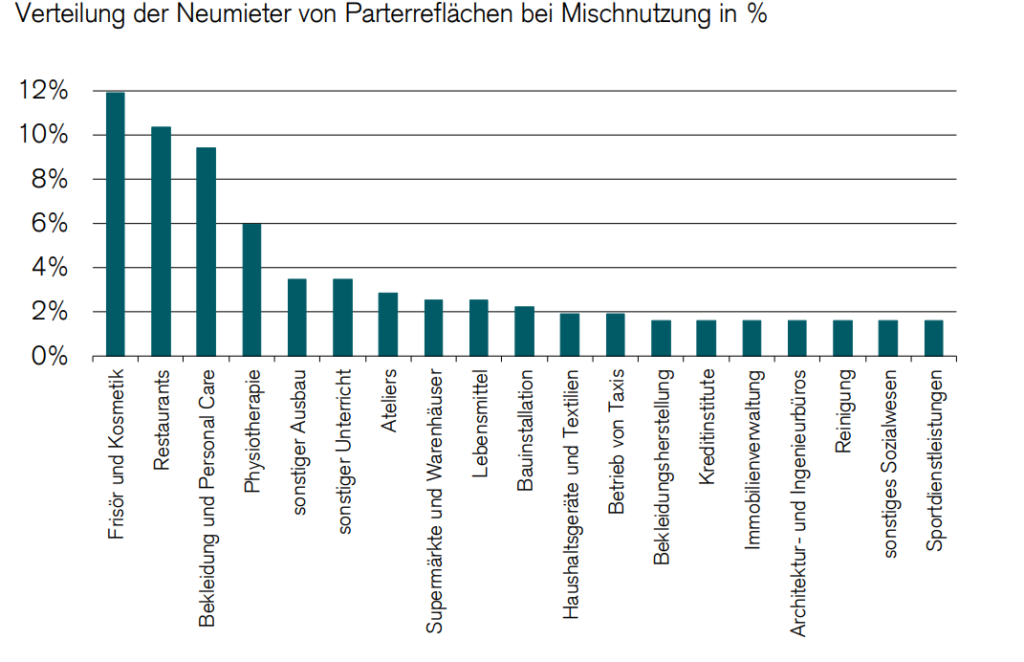

When a Swiss store closes, it is often not replaced by another. Instead, hairdressing or beauty salons, cafés, or architectural firms move in. Only about 20 percent of the vacant retail space (on the ground floor) is re-rented to a retailer.

New point-of-sale concepts are needed to utilize space efficiently and offer customers a shopping experience. A dangerous vicious circle is looming here! When retail spaces are vacant, it has negative consequences for landlords, retailers, and ultimately for spatial development. Where there’s nothing, there are no people. Vacant spaces lead to a decline in footfall. This harms remaining retail outlets, and vacant spaces become even more difficult to lease – leading to even more Swiss stores dying. Modern concepts with potential for success include shop-in-shop concepts, event spaces, and pop-up stores.

The solution: online trading

Switzerland is becoming more digital. Analyses show that internet usage has increased significantly. The strongest increases are among people over 60. Five years ago, 36% of “silver surfers” used the internet daily; today, that number has risen to 50%.

In addition to rising internet usage, the proportion of the population who regularly shop online has also increased. Online retail sales in Switzerland amounted to CHF 9.5 billion in 2019, and the trend is rising. Of this, 80% went to Swiss providers (CHF 7.6 billion) and the remaining 20% (CHF 1.9 billion) to foreign online retailers. Zalando alone generated estimated sales of CHF 840 million in Switzerland in 2018, corresponding to 44% of foreign retailers’ sales. Sales are even estimated to reach CHF 900 million in 2019.

The impact of online sales varies depending on the business model. In Switzerland, the online sales share in the food/near-food sector is approximately 3%, while in the non-food sector, approximately 18% of sales are already made online. Nevertheless, even significant sales growth in the in-house online shop often cannot (yet) compensate for the decline in sales in retail space, or only partially. Online retail is still in its infancy in Switzerland.

Conclusion on Swiss shops dying: How near is the end?

Is the retail sector on the verge of extinction? No. The analyses of the latest Credit Suisse study show that the majority of retailers and manufacturers surveyed are achieving their budgeted sales and profits. Nevertheless, the market is changing, and the signs cannot be ignored in the long term.

Digital is reality! Closing both eyes and waiting is reckless. It’s important that everyone familiarizes themselves with the topic in their own area. How can the internet influence my business? What do my customers want? What is my competition doing?

Once the areas have been identified, a slow approach is recommended. You don’t have to bet 100% on digital right from the start. A simple example for online retail is MyCOMMERCE. With the free offer, anyone can get a free, non-binding impression of our online shop solution and familiarize themselves with the topic. Go for it!